- MBA FPX 5014 Assessment 2 Capital Projects Evaluation.

Summary

Drill Tech, Inc., has asked me to analyze three capital projects and recommend which will value the company more. As the finance manager, making an informative decision on these projects will benefit Drill Tech, Inc. by helping our company create and expand. The proposed projects are Project A, a Major Equipment Purchase; Project B, an Expansion into Europe; or Project C, a Marketing/Advertising Campaign.

The reason for this report is to analyze each project through budgeting tools and propose my recommendation for the more beneficial one. I will give detailed directions and related information to assist my recommendation; for us to make a formal decision regarding which project would bring the most value to our shareholders, my team and I have applied capital budgeting techniques to calculate what’s in store projects’ cash stream to compare each project appropriately. Explore our assessment MBA FPX 5014 Assessment 1 for more information.

Information Given on the Projects

The proposed projects for you to study are according to the accompanying information. This is the information given to help you make the best decision possible.

Project A: Major Equipment Purchase

Another major equipment purchase will cost $10 million despite the long-term decrease in sales cost of 5% each year.

The equipment is projected to be sold for a salvage value estimated at $500,000 after year 8.

The required rate of return for the project is 8%.

MACRS 7-year schedule on equipment for depreciation.

Annual sales for year 1 are projected at $20 million and should stay the same each year for a surprisingly long time.

Before this project, the cost of sales was 60%.

The marginal corporate tax rate is attempted to be 25%.

Project B: Expansion into Europe

• Expansion into Western Europe is forecast to increase sales/incomes and cost of sales by 10% each year for a considerable period.

• Annual sales for the earlier year were $20 million.< br//>• Start-up costs are projected to be $7 million, and an upfront required interest in net working capital of $1 million. The functioning capital amount will be recouped after year 5.< br//>• Because of the greater European tax rate, the marginal corporate tax rate is required to be 30%.

• Being a hazardous endeavor, the expected rate of return of the project is 12%.

Project C: Marketing/Advertising Campaign

• A major new marketing/advertising campaign will consistently cost $2 million for the last 6 years.

• It is forecast that the campaign will increase sales/incomes and costs of sales by 15% each year.

• Annual sales for the earlier year were $20 million.

• The marginal corporate tax rate is required to be 25%.

• Being a moderate gamble speculation, the necessary rate of return of the project is 10%.

Budgeting Tools

Capital Budgeting

Capital budgeting includes choosing projects that add value to a company. Capital budgeting can consist of almost anything, including acquiring land or purchasing fixed assets like another truck or machinery. [ CITATION Art20 \l 1033 ].

Pinkasovitch states that corporations must undertake projects that increase profitability and shareholders’ wealth (2020). As part of capital budgeting, we will assess each prospective project’s lifetime cash inflows and spills over to decide whether the potential returns are adequately significant to place resources into the project [ CITATION Wil \l 1033 ].

Capital Budgeting Decision Process

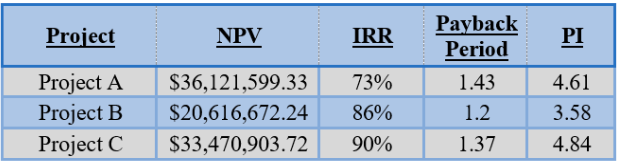

While applying capital budgeting to make an endeavor decision, decide the potential profit of the project, assess the gamble, choose the project, and then execute it. Management uses capital budgeting techniques to determine which projects will yield the best return over an applicable period [ CITATION Wil \l 1033 ]. To successfully conclude this task, I have applied capital budgeting tools and strategies to calculate the Net Present Value (NPV) and Internal Rate of Return (IRR). Payback Period and Profitability Outline (PI). After figuring out these calculations, deciding which projects will benefit Drill Tech, Inc. should be easy.

Net Present Value (NPV)

The principal calculation to consider is Net Present Value (NPV). NPV is one of many capital budgeting techniques used to evaluate potential physical asset projects to which a company should contribute. Net present value includes discounted cash streams in the analysis, which makes the net present value more precise than any of the capital budgeting strategies as it considers both the gamble and time variables. As outlined in the MBA FPX 5014 Assessment 2 Capital Projects Evaluation, using Microsoft Excel, we calculated the NPV of each project to establish a common denominator with which to compare the profitability of each project. The advantage of the net present value technique is that it considers the basic idea that a future dollar is valued under a dollar today.

In each period, the cash streams are discounted by another period of capital cost. Another advantage is the NPV gives management the dollar value the endeavor will create for the company rather than a rate or percentage of another factor [CITATION Wil20 \l 1033]. One noticeable disadvantage of NPV is that this strategy requires some secret information about the association’s cost of capital. Assuming a cost of capital that is too low will bring about suboptimal speculations. Assuming a cost of capital that is too high will bring about renouncing such a large number of savvy adventures [CITATION Wil20 \l 1033].

Internal Rate of Return (IRR)

The second calculation used is the Internal Rate of Return (IRR). IRR assists managers in sorting out which potential projects add value and legitimacy to undertaking [ CITATION Ada20 \l 1033 ]. With IRR, there are apparent advantages and disadvantages. One major benefit is that the planning of cash streams in all future years is considered, and, therefore, each cash stream is given an equal load by using the time value of money[ CITATION Ada20 \l 1033 ].

Unfortunately, a major disadvantage of this budgeting instrument is that it doesn’t account for the project size while comparing projects[ CITATION Ada20 \l 1033 ]. Cash streams are compared to the capital outlay generated by those cash streams. This can be troublesome when two projects require a significantly remarkable amount of capital outlay, but the smaller project returns a higher IRR[ CITATION Ada20 \l 1033 ]

Payback Period

The third calculation is the payback period. Given this period, businesses will generally focus on projects with a faster, more profitable payback probability.

[ CITATION Ros19 \l 1033 ]. The payback period rule for making speculation decisions is basic and potentially informative. The payback tells us when the cash flood of speculation is “paid back” by cash inflows[ CITATION Ros19 \l 1033 ]. Cash streams, initial enendeavorand other factors are considered when calculating a capital project’s payback period.

Like every other device used, this budgeting technique has advantages and disadvantages. A couple of disadvantages are it disregards the planning of cash inflows inside the payback period and the time value of money [ CITATION Ros19 \l 1033 ]. The payback period is easier to understand, and the calculation process is quicker and less complex than other strategies.

Profitability (PI)

The final calculation we use to decide is the Profitability Record (PI). PI measures the ratio between the present value of future cash streams and the initial endendeavorCITATION Ros20 \l 1033 ]. The record is useful for ranking speculation projects and showing the value created per adventure unit. The project with the most critical PI is the most attractive[ CITATION Jam20 \l 1033 ]. An advantage of using this technique is the PI evaluates all cash streams and illustrates whether an endeavor increases firm value[ CITATION Jam20 \l 1033 ].

Recommendation

Based on the calculations, all the projects are beneficial to the company. All produce profit for our company. More than others, a couple of projects are recommended for the company. As seen above, Project A is the most imperative NPV for the company at $36,121,599.33. Project B is the weakest of the potential projects. To be certain, their payoff is more restricted, but they are losing substantially on the NPV and PI between the three. Considering the disadvantages of the payback period, this device alone wouldn’t be a strong instrument for deciding on speculation. In contrast to NPV, it doesn’t consider the cash stream after the break-even point, which is $33 million. These insights are part of the analysis conducted in the MBA FPX 5014 Assessment 2 Capital Projects Evaluation.

The IRR of Project C is the most important, but the present value of the net cash stream isn’t exactly that of Project A. Assuming that you attempt to decide between NPV or IRR, it is always better to have a higher NPV. The NPV strategy presents an outcome that frames the foundation for an endeavor decision since it presents a dollar return [CITATION Ste20 \l 1033].

The IRR strategy doesn’t help in making this decision since its percentage return doesn’t tell the financial backer how much money will be made [CITATION Ste20 \l 1033]. On the other hand, NPV doesn’t experience the slippery effects of such a challenging assumption because it assumes that reinvestment occurs at the cost of capital, which is conservative and realistic.

Project A should be selected. However, we would also be strong if we selected Project C instead. Both have higher NPVs and around the same payback periods for our company. Both will benefit Drill Tech, Inc.

References

Bragg, S. (2020, October 16). The difference between NPV and IRR. Retrieved from Accounting Tools: https://www.accountingtools.com/articles/the-difference- between-npv-and-irr.html#:~:text=The%20NPV%20method%20results%20in,flow%20level%20of%20a%20project.

Carlson, R. (2019, NoNovember9). Payback Period in Capital Budgeting. Retrieved from The Balance Small Business: https://www.thebalancesmb.com/payback-period-in- capital-budgeting-392916

Carlson, R. (2020, May 29). What Is Profitability Ratio Analysis? Retrieved from The Balance Small Business: https://www.thebalancesmb.com/profitability-ratio- analysis-393185

Chen, J. (2020, October 20). Profitability Index. Retrieved from Investopedia: https://www.investopedia.com/terms/p/profitability.asp

Hayes, A. (2020, September 2). IRR. Retrieved from Investopedia: https://www.investopedia.com/terms/i/irr.asp

Kenton, W. (2020, August 19). Capital Budgeting. Retrieved from Investopedia: https://www.investopedia.com/terms/c/capitalbudgeting.asp

Kenton, W. (2020, August 17). NPV. Retrieved from Investopedia: https://www.investopedia.com/terms/n/npv.asp

Pinkasovitch, A. (2020, October 7). An Introduction to Capital Budgeting. Retrieved from Investopedia.