Assessment 1 Part 1: Cost Data for Managerial Purposes

Scenario

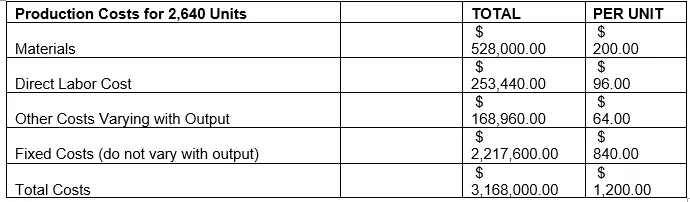

The T-Rex employer dissimilates products. It is prepared in two divisions, East and West. The managers for each department are paid, in part, based totally on the monetary performance of their divisions. The West division typically sells to outside clients but, once in a while, additionally sells to the East department. While it does, corporate coverage states that the fee should be valued plus 15 per cent to ensure an “honest” return to the promoting division. West obtained an order from East for six hundred gadgets. West’s deliberate output for the 12 months was 2,640 gadgets earlier than East’s order. West’s capability is three a hundred gadgets, consistent with the year. The expenses for producing those 2,640 units comply with the following:

This problem demonstrates the paradox in measuring “expenses.”

West department’s controller blanketed the “in step with unit” fixed fees, which were calculated for allocation under ordinary production quantity. In contrast, they calculated the per unit price of the additional production. The controller charged the East department on that foundation, ignoring the differential expenses as a basis for inter-division sales.

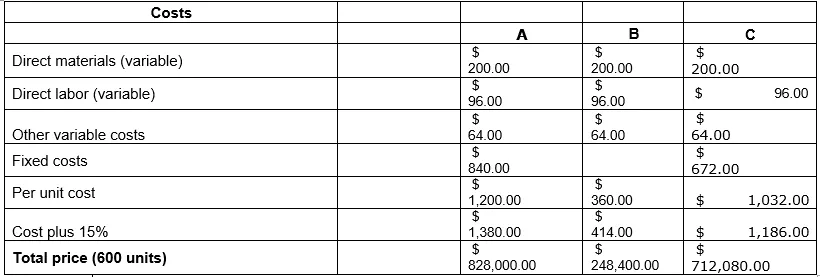

Feasible preferences to be had are as follows:

A. Use the entire in line with the unit cost for the everyday production of two 640 gadgets.

B. Use solely differential prices because of the price foundation.

C. Use differential prices plus a percentage of fixed charges based on real production extent (with East’s order) of 3 three hundred units.

REQUIRED

a. if you are the supervisor of the West division, what unit value would you ask the East division to pay? Display calculations. Unit A has the most revenue and considers the constant costs.

b. if you are the manager of the East department, what unit value might you argue you need to pay? Display calculations.Unit B fee. This is because it would yield the least price to the East division.

c. What unit value might you advise for selling gadgets from the West division to the East department? Give an explanation for it in short. Unit A. That is because Unit A is a more correct costing technique than Unit B or Unit C. This may incur fixed prices whether the West department solely produces what’s planned or complete capacity.