MBA FPX 5008 Assessment 1

Reacting to Market Volatility

-

Slide 01

Greetings! My name is Student and I will be presenting the graphical information analysis on low stock investments and factors that affect it.

Business Context

-

Slide 02

This means that while investment companies cannot buy stocks because there are not enough buyers, their finances are almost always more difficult to manage and they end up failing. In formulated research, the survey was conducted to examine how financial companies fared in the current market and the perception within the United States populace about them as highlighted in a piece in Kiplinger’s Personal Finance publication (Kiplinger’s Personal Finance, 2020). They would always want to seek more investors towards achieving its objectives of making money and capital. Such investors are often working in the USA and looking forward to saving for their retirement (Wen et al. , p. 73, 2021). Therefore, when the investment firm is aiming at getting new buyers, then it must have a look at the kind of market attached to stocks and some feelings that people may have regarding the same at some point. The manner in which they would manage their money with aim of spending it on the trip impacts on the corporate landscape that the company finds itself in.

Relevance/Importance of Information

-

Slide 03

The details of the selected article pertain to the various options of savings and investment made by the people of United States prior to their retirement. Some of these trends include resident’s savings in cash, buying of real state, bonds, stocks or any others as pointed by Möller (2021). It can be useful in determining the perception of stocks in the eyes of the common populace of a given country, region or the world at large. That the changes in investments have the following implications; they are characterized by fluctuation of markets (Wen et al. , 2021). Consequently, it is more possible for the investors to be aware of the volatility level of the company before investing on the company’s securities. With this information, the company has the chance to map the strategy and target other possible consumers if it expects such persons to leave the stock, as pointed by Möller, 2021.

Source of Data Set and Limitations

-

Slide 04

The data was generating a forecast of the investors’ attitude towards the market risk in the US market. The reported data indicates that there is a change in investment priority of these investors in the country the associated behavior is good. That is actually Kiplinger’s Personal Finance is a data collection and analytical entity which analyzed data from a survey conducted by Brown Oak Audience Insight 2019. Before their retirement, there were 850 people (curtailing at 40 years) who responded to various questions ranging from retirement savings, mode of investment, and preference (Kiplinger’s Personal Finance, 2020).

MBA FPX 5008 Assessment 1 Reacting to Market Volatility

Therefore, the data reported for this business case is actually based on the data arising from a reliable source. In the survey, it was assumed that the amount of money which was not taken into account was each of the participants’ annual income (Kiplinger’s Personal Finance, 2020). These income streams also influence the investment opportunities in relation of the various individuals. Hence, lack of the information that describes income levels that different persons within the society receive is the main limitation of the selected data from the article ‘Reacting to Market Volatility’.

Graphical Representation and Interpretation

-

Slide 05

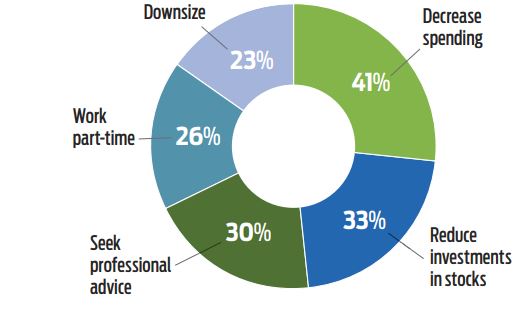

Graph 01: Looking Ahead to Retirement

The data quantifies the precise choice the investors are likely to make given the equity market risk on retirement saving. It is thus, possible to connect these options with the change in market volatility through people’s perception that reviewing these five options are the best options available (Chen et al. , 2021). When responding to questions about their behavior during stock market fluctuations, 41% of investors responding mentioned that they would cut their spending if the value of stocks went down. Likewise, the investment of the stocks of the investment company will decline resulting into a decrease in revenues by respondents’ 31%. 23% said they will downsize their household, 26% mentioned they would get a part-time job for increased pay and 30% said they will speak to a financial advisor in the event of heightened market activity. The investment company should be prepared through others from different backgrounds before they lose 33% of pre-retirees as its investors (Möller, 2021). The market volatility can hence, lead to loss of its clients and this implies that the business will in the future loose a bigger percentage of its revenue earnings.

Graph 02: Dealing with Stock Market Volatility

-

Slide 06

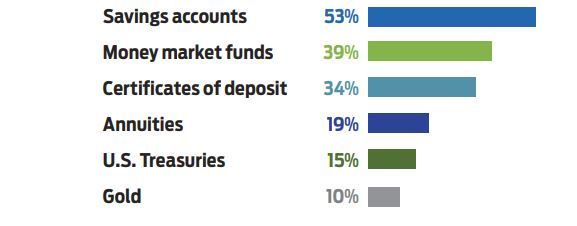

The graph above show what the US residents plan to do in case the market turn volatile as shown below. 53% of inventors would actually put more of their money into savings accounts especially if there is a volatility in the stock market further in the future. Similarly, investors appear to prefer money market funds, certificates of deposits, annuities, US Treasuries, and gold with 39%, 34%, 19%, 15% and 10% of the investors choosing these items as their alternate investments. It will therefore shift from share trading to saving accounts the coming years if the volatility in the US share market rises (Ashta & Herrmann, 2021). It is crucial to highlight other sources of revenue that the investment company under discussion is to be set as the business context of this presentation. It is possible for the company to decide to serve as a saving accounts service for its investors in which the investors cannot transfer their investments due to fluctuations in the stock market (Möller, 2021). Therefore, involving information in a graph is valuable for the current business environment.

Importance of Data Analysis for Business Context

-

Slide 07

The planning that the people in the US wants to take regarding the market crash is illustrated in the following picture. Thus, 53% of inventors stated that they would invest even more funds in the saving accounts in the future if the situation on the stock exchange market remains unstable. Regarding the figure of the money market funds 39 percent of the buyers preferred the money market funds 34 percent preferred the certificate of deposit 19 percent preferred pension 15 percent preferred the US Treasury and 10 percent preferred gold as an alternative investment. That is why if the situation in the US market becomes even more unpredictable in the next several years, people will shift from stock investing to depositing money in savings accounts – Ashta & Herrmann, 2021. It is important to learn other methods through which the finance company – the focus of this presentation – can generate income. The company can provide to the clients savings accounts so that they would not have to transfer the money when the stock exchange rises and falls (Möller, 2021). Because of this the information located on the graph is valuable to business at the present time.

Summary/Conclusion

-

Slide 08

Some of the impacts include the fluctuation of stocks that relate to stock buying in the US. The investment companies primarily depend on the population aged within the working years and planning to invest and earn from the stock buying and other related profits. One of the worst scenarios of the market can be the complete exclusion of this stock purchase as an investment to these target customers. The 2019 survey undertaken by the Brown Oak Audience Insights showed that the US residents were willing to shift to other choices such as savings accounts, buying gold, cutting down on stocks, and annuities. Therefore, the business had to look for other means of generating revenues in order to introduce such options of investment and remain in business in the united state of America during stock fluctuations.

If you need complete information about class 5006, click below to view a related sample:

MBA FPX 5006 Assessment 2 Business Strategy

References

Ashta, A., & Herrmann, H. (2021). Artificial intelligence and fintech: An overview of opportunities and risks for banking, investments, and microfinance. Strategic Change, 30(3), 211–222.

https://doi.org/10.1002/jsc.2404

Chen, Y., kumara, E. K., & Sivakumar, V. (2021). Investigation of finance industry on risk awareness model and digital economic growth. Annals of Operations Research, 1(1), 1–22.

https://doi.org/10.1007/s10479-021-04287-7

Kiplinger’s Personal Finance. (2020, January 8). Saving for retirement: How to react to market volatility. kiplinger.com.

Möller, S. (2021). Connecting local government with global finance: Professional service firms as agents of financialization. Professional Service Firms and Politics in a Global Era: Public Policy, Private Expertise, 1, 175–194.

https://doi.org/10.1007/978-3-030-72128-2_9

Wen, F., Cao, J., Liu, Z., & Wang, X. (2021). Dynamic volatility spillovers and investment strategies between the Chinese stock market and commodity markets. International Review of Financial Analysis, 76.