Scenario:

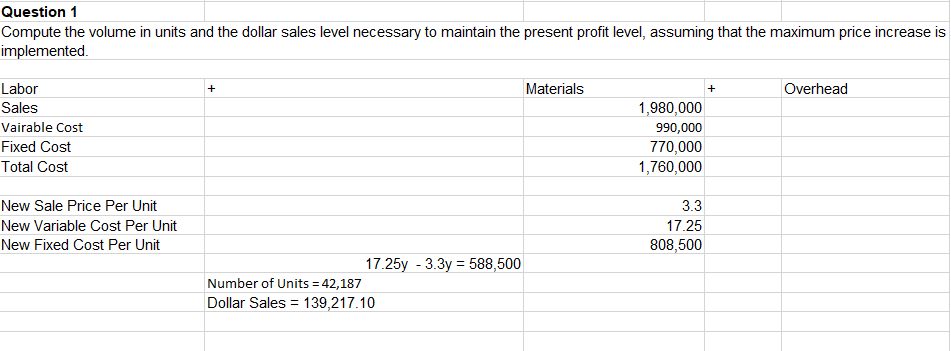

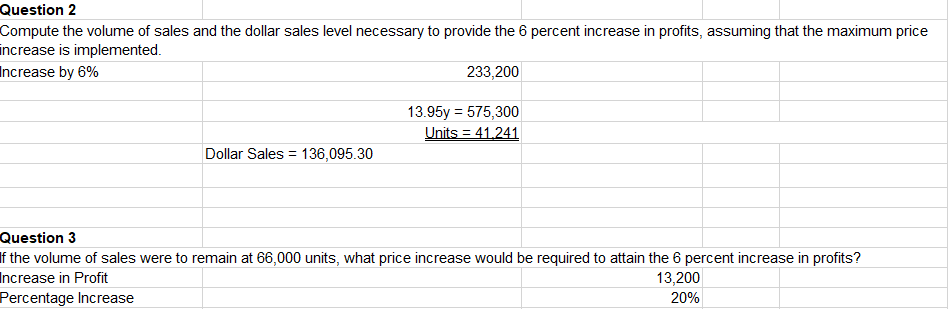

Toronto partners are concerned about the possible consequences of inflation on their operations. The corporation sells sixty-six devices for $30 per unit. The variable production fees are $15, and fixed expenses are $770,000. Manufacturing engineers have recommended the expectation that unit tough painting fees will be upward thrust through the method of 15 per cent and unit materials fees will be upward shoved with the resource of 10 per cent in the coming 12 months. Of the $15 variable prices, 50 per cent are from complex paintings, and 25 per cent are from materials. Variable overhead prices are anticipated to grow by 20 per cent. Sales expenses can not increase more than 10 per cent. It is also expected that steady prices will rise by five per cent due to expanded taxes and various miscellaneous regular costs. The organization desires to hold an identical income level in real dollar terms. It is predicted that earnings need to grow by 6 per cent for twelve months to accomplish this goal.

REQUIRED

BUS FPX 4064 Assessment 1 Part 4 CVP Analysis and Price Changes