- MBA FPX 5008 Assessment 3 Applying Analytic Techniques to Business.

Microsoft Corporation

Microsoft is a global information technology titan company. Microsoft develops and engages in the manufacturing of computer software and services, gadgets, and solutions across the globe (Yahoo Finance, 2019). Products are generally improving over time.

The best-known product of Microsoft is Microsoft Windows which has extended its market share to about 35. It held 5% of the operating system market share in March 2019 (StatCounter, 2019), Office 365 Commercial Products and Services which is cloud-based, and Microsoft Azure which is a cloud-based platform for storage and analysis of data (Yahoo Finance, 2019).

Microsoft in the past focused on software, but as of 2013 when Steven Anthony Ballmer took the seat of Chief Executive Officer, Microsoft stated that it would shift its focus to selling hardware products and services (Belanger, 2018).

Hence, there were more phones, tablets, PCs, and game gear such as Xbox. However, this change did not proceed as expected, to a large extent, because the idea of Microsoft acquiring all of Nokia’s Devices and Services business failed miserably (Belanger, 2018).

This was when Satya Nadella took the helm as the CEO in 2014 when Ballmer stepped down; Microsoft refocused itself on business technology services and cloud computing to be able to make profits (Belanger, 2018). Recently, the company has been able to generate a lot of profits such as buying LinkedIn, enhancing the Office 365 services, and rolling out of the Azure Microsoft (Belanger, 2018).

For the last five years, Microsoft has been experiencing an annual growth rate of 1. 4%. The management of the company expects the company’s profits to increase by 7. The Referral CAGR was at 5% in 2020 (Simply Wall ST, 2019).

Microsoft recorded 8 as their profit. This business grossed about 6 billion U. S. dollars and produced nearly 32. Its sales were at 5 billion U. S. dollars in the last year. This goes to show that the company is in good shape and has a bright future.

$7. 6 billion because Azure sales increased by 76 percent, and Surface computers and laptops sales increased by 39 percent (Weise, 2019).

Graphical Representations of Data

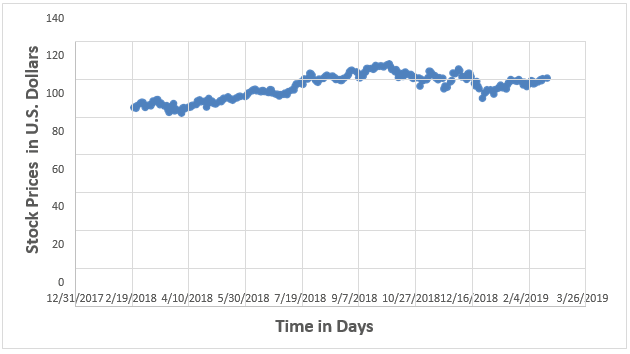

Interpreting the Scatterplots

Figure 1.1. Scatterplot of the highest stock prices of Microsoft based on data from Yahoo Finance (2019)

From February of the year 2018 up to February of the year 2019, Figure 1. 1 depicts the trend in Microsoft’s stock prices at their highest level. The graph shows the connection between two variables: The data includes the time (in days) as well as the highest stock prices (in U. S dollars).

MBA FPX 5008 Assessment 3 Applying Analytic Techniques to Business

On the y-axis, there are the highest stock prices, and on the x-axis, there are the time indications. The scatterplot is straight: In 2018, stock prices that have risen the most have a rather positive association with time. In 2018, the costs of the most expensive Microsoft stocks also rose in value.

However, the link is somewhat weak because the best stock prices have not greatly appreciated in value over time and there are some that have slightly depreciated in value. The prices dropped towards the end of 2018 and then rose again in the month of February 2019. There are no critical outliers in this analysis thus it can be concluded that the results are relatively accurate.

Figure 1.2. Scatterplot of the lowest stock prices of Microsoft based on data from Yahoo Finance (2019)

In Figure 1. Here is an example, you can view the graph of the share prices of Microsoft where the prices are declining from February 2018 to February 2019. This gives the link between the two variables as is depicted in the graph. The y-axis represents the minimum stock prices (in U.S. dollars) and the x-axis represents the days.

MBA FPX 5008 Assessment 3 Applying Analytic Techniques to Business

From the scatter plot, it is possible to observe a slightly positive correlation between the time and the lowest stock prices. The stocks with the lowest prices in the market rose from the period of March to October for about seven months.

From October up to December, there were slight changes in the value which sometimes increased or decreased. The correlation shown in the scatterplot is positive and fairly weak due to the small slope; it means that the lowest stock prices are not very volatile. From the scatterplot, it is also possible to notice that there is no significant dispersion, which confirms that the market share of Microsoft is predictable.

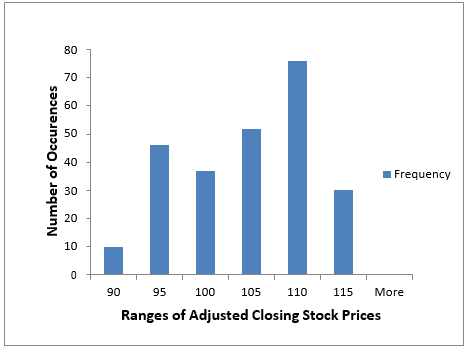

Interpreting the Histograms

Figure 2.1. Histogram of adjusted closing stock prices of Microsoft based on data from Yahoo Finance (2019)

In Figure 2. From Table 1, it is possible to observe how many times the daily adjusted closing stock prices were within the evenly distributed continuous data bands. On the x-axis, there are the ranges of the corrected ending stock prices. What is displayed on the y-axis is the frequency of occurrences of price within these ranges.

A vast majority of the data points are located in the higher regions of the daily adjusted closing stock prices. This implies that the histogram is positively stretched, or skewed, to the left. This means that the graph is negatively skewed and therefore the median is higher than the mean. This reveals that the modified closing stock prices of the Microsoft Company in the market is quite volatile.

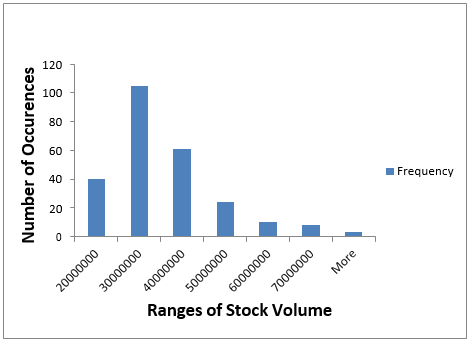

Figure 2.2. Histogram of the stock volume of Microsoft based on data from Yahoo Finance (2019)

In Figure 2, you can see the frequency of buying and selling of the daily stock amount of Microsoft in constant data sets. The horizontal axis indicates the ranges of stock volumes while the vertical axis indicates the number of occurrences of such stock volumes.

Since the graph is positively skewed, the majority of the values of the daily stock volume are located in the lower part of the graph. Since the mean is greater than the median it shows that the histogram is positively skewed.

The distribution of the data is strongly positively skewed as 80% of the data points are clustered towards the lower end of the stock volume. In this case, the data is said to be skewed and one cannot easily predict the number of Microsoft stocks that are traded daily.

Descriptive Statistics

Mean, Median, and Standard Deviation of Adjusted Closing Stock Prices

The mean, or average value of a set of numbers, of Microsoft’s stock prices at the end of the trading day is 101. 939 U. S. dollars. This indicates that Microsoft stock is doing well in the market as is seen from the above graph. The sales and income figures have been relatively on the rise throughout the year which is a sign of healthy business.

If you want to find a middle item of a list of numbers, there is a term for it – the median. Mean is the arithmetic average of the numbers in the set. The middle stock price of Microsoft in the course of the day was 103. The amount reported is $249 U. S., which is above the average.

MBA FPX 5008 Assessment 3 Applying Analytic Techniques to Business

This is an indication that there are out standards at the lower end of the stock prices, this being an indication that the price of Microsoft stock fluctuates a lot. This difference between the mean and the median also points to the fact that the numbers of changed closing prices are not evenly distributed.

The mean of the stock is 101. Thus, the standard deviation for the corrected ending stock prices is 6, which means that the average of the corrected ending stock prices is 939 US dollars. 953 U. S. dollars. This means that the volatility is 6. 7%. That is why the standard deviation reveals the extent of the price fluctuations of the stock and, therefore, the level of risk of investing in the stock. The standard deviation indicates that investing in Microsoft shares is characterized by rather low variability.

Mean, Median, and Standard Deviation of Daily Traded Stock Volume

Seth (2018) revealed that the daily trading volume of Microsoft shares from February 2018 to February 2019 was 31,210,598. This proves that the stock of the company is highly liquid. Research has indicated that stocks, that are transacted less than 10,000 shares every day, are classified as low-volume stocks (Seth, 2018).

Microsoft’s daily traded stock volume reveals that there are many people interested in buying the company’s stocks thus making it to be very valuable. The middle number of the number of shares is 28,123,200 which is less than the mean of the number of shares.

These numbers indicate that there are higher frequency on the right tail of the distribution, therefore indicating that the company’s daily tradeable stock volume increases. What the audience would find out is that the standard deviation is 12,909,909. 8 which is equivalent to 41.

It is possible to identify that the average deviation does not exceed 3% of the mean for trade volume. It can be noted that the standard deviation is 12,909,909. This, therefore, means that the data set is very volatile since 8 is a high figure. This implies that the number of stocks in Microsoft is relatively not very constant.

Conclusion

Probability calculations and graphs of Microsoft stock in the past provided managers with correct information to use in determining which products to release and how the firm can expand. Here are some important trends that leaders should be aware of: Here are some important trends that leaders should be aware of. The highest and the lowest stock prices gradually increase in the second and third quarters, but increase and decrease in the fourth quarter again.

A significant number of more than a quarter of the adjusted closing stock prices were within the high value ranged 105 to 110 which denotes there is indeed a high demand. The increase or decrease of the traded stock volume daily is also vigorous (41. 3%) Thus, it’s extremely difficult to predict Microsoft’s Stock exchange rate. Fluctuations in stock numbers indicate that perhaps a company produced more profits than anticipated or the market got good or bad news about the company or the sector (Morah, 2018).

Management may also get to understand how the prices of stocks fluctuate so that they may introduce new products or come up with enhanced products at the start and at the end of the year. This could help fuel the sales during those periods which, in turn, could bring more growth in the gross revenue and profits during the stable third and fourth quarters.

Many of the data points in the graph in corrected closing stock prices, especially in H-Stock, are above 105 to 110 U. S. dollars which is the normal price range of a lot of stock in everyday business. This may lead to the management’s desire to increase the stock owned by them two times by offering half the price of each share. It could assist in the creation of demand for the stock as well as elevate the company’s value in the marketplace.

MBA FPX 5008 Assessment 3 Applying Analytic Techniques to Business

The following are the scatter plots of the top and the lowest daily stock prices With reference to the above findings, it was evident that there was a positive linear relationship between time and stock values. This is helpful in preventing us from settling for the worse while being ignorant of the fact that we could have had the better.

Organic sales growth of Microsoft has increased in the year 2018 as compared to previous years. They also demonstrate that price levels were above those observed at the end of 2018 to the beginning of 2019 in the early part of 2019. This has illustrated the fact that the company made 32 for the quarterly financial performance which ought to be a norm of the company’s performance.

This apart, Nestle which earns over 5 billion of the U. S. dollars in sales had a great impact on its market value at the beginning of 2019. It can also be seen from the histograms that the median for the adjusted closing stock prices was more to the right than the median for the stock volume which was towards the left. This indicates that many users demanded Microsoft’s stocks, but sellers were not willing to offer their own.

This correlates with the pattern of Microsoft getting better at issuing out payments at that time (Weise, 2019). It may be because the trading volume of Microsoft represented in the figure changes at a lesser rate compared to the change in the price of its stock. Read more about our sample MBA FPX 5008 Assessment 2 Using Analytical Techniques to Add Meaning to Data for complete information about this class.

References

Belanger, L. (2018, April 4). 10 amazing moments in Microsoft’s history, from its founding to desktop dominance to today. Entrepreneur India. Retrieved from

https://entrepreneur.com/article/311468

Morah, C. (2018, March 2). Are stocks with large daily volumes less volatile? Retrieved from

https://investopedia.com/ask/answers/09/daily-volume-volatility.asp

Seth, S. (2018, January 10). The risks of trading low-volume stocks. Retrieved from

https://www.investopedia.com/articles/active-trading/051415/risks-trading-lowvolume- stocks.asp

Simply Wall St. (2019). Microsoft Corporation (NASDAQ: MSFT): What does the future look like? Retrieved from

StatCounter. (2019). Operating system market share worldwide. Retrieved from

http://gs.statcounter.com/os-market-share

Weise, K. (2019, January 30). Releasing earnings, Microsoft stays in stride, with the cloud powering the way. The New York Times. Retrieved from

Yahoo Finance. (2019). Microsoft Corporation (MSFT) [Data set]. Retrieved from