DNUR 6211 Week 4 Assignment 3 FREE DOWNLOAD

DNUR 6211 Week 4 Assignment 3

Healthcare Budget Request – Estimating Expenses

Student Name

Walden University

DNUR 6211: Finance and Economics in Healthcare Delivery

Professor name

Date

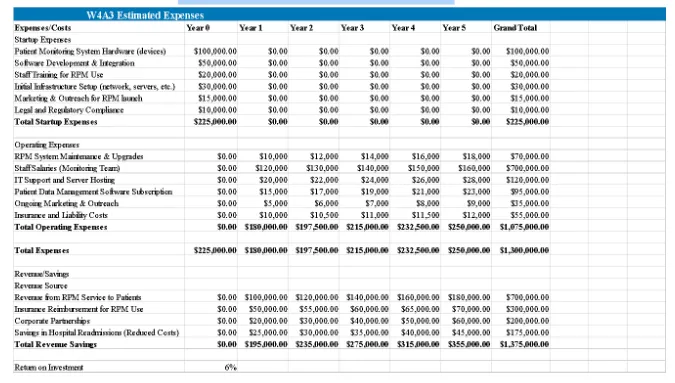

Part 1: Expense/Revenue/ROI Analysis

Part 2: W4A3 Projected Expenses and Revenues (Five Year)

Summary of Analysis and Interpretation of Results

Adopting a Remote Patient Monitoring (RPM) system at HealthWays Clinic is anticipated to yield significant operational and financial benefits over the next five years. The total projected expenses, encompassing startup and operating expenditures, are estimated at $1.3 million. This includes an upfront allocation of $225,000, covering hardware, software development, infrastructure setup, staff training, and legal compliance. Additionally, annual operational costs—system maintenance, staff salaries, IT support, and marketing efforts —are expected to amount to $1.075 million across the same period.

On the other hand, the clinic forecasts a combined revenue and cost savings of $1.375 million. Key contributors include $1.2 million from patient service fees, insurance reimbursements, and business collaborations, alongside $175,000 saved by minimizing hospital readmissions. This translates into a modest 6% Return on Investment (ROI), equating to an incremental 6 cents in net financial value for every dollar invested.

The formula for Return on Investment (ROI) is:

ROI=Net Profit (Total Revenue Savings – Total Expenses) / Total Expenses×100

Step 1: Calculate Net Profit

From the table:

- Total Revenue Savings: $13,75,000.00

- Total Expenses: $13,00,000.00

Net Profit = Total Revenue Savings – Total Expenses

Net Profit=13, 75,000−13, 00,000=75,000

Step 2: Calculate ROI

ROI=Net Profit/ Total Expenses×100

ROI=75,000/ 13, 00,000×100

ROI=5.77% round off to 6%

Beyond the numerical ROI, the RPM system offers transformative advantages. By curbing hospital readmission expenses and streamlining care delivery, it aligns seamlessly with HealthWays’ vision of bolstering service quality and ensuring operational sustainability (Thomas et al., 2021). Furthermore, this initiative underscores the clinic’s commitment to pioneering advancements in healthcare, reinforcing its reputation as a leader in adopting cutting-edge medical technologies to enhance patient outcomes.

Instructions To Write DNUR 6211 Week 4 Assignment 3

Need instructions for this assessment? Contact us now and get expert guidance right away!

Instructions File For 6211 Week 4 Assignment 3

W4A3 HEALTHCARE BUDGET REQUEST – ESTIMATING EXPENSES

It can be tempting to think of “dreams” and “finance” as opposite ends of a spectrum. You may dream of things you want, such as new cars, vacations, or retirement. But a quick analysis of your current finances may awaken you to find that your dream is not yet financially feasible.

Dreams and finance are, in fact, not at all in opposition. If your dream is a new automobile, you soon come to realize that you’ll need a plan to make your purchase. Part of this planning is based on an understanding of your current financial position.

Saving money will help you, and whatever cost is not covered by savings can possibly be made up for by financing. You’ll likely need a personal budget that accounts for any new expenses you incur, such as a monthly car payment, insurance, and fuel.

Organizations have dreams, manifested as corporate objectives. Proposals for new products or services must support these objectives, typically demonstrated via a business case. But these ideas almost always require resources. By understanding current financial position, the revenue streams and expenses, and creating budgets, strategies can be developed that make the dream a reality. You will also estimate revenues and calculate a return on the proposed investment.

RESOURCES

Be sure to review the Learning Resources before completing this activity.

Click the weekly resources link to access the resources.

TO PREPARE

Reflect on the healthcare product or service solution you have proposed for your healthcare organization. Consider expenses (including start-up expenses and any capital expenditures) that will be required to implement your product or service.

Reflect on the estimated revenues (if any) that your proposed solution will generate. If your project does not generate a direct revenue source, consider cost avoidance, or cost savings as an alternate potential revenue source.

Reflect on the need for financing to meet the estimated expenses associated with your idea.

For each of the above, consult with your internal financial counselor as needed.

THE ASSIGNMENT: ESTIMATING EXPENSES

Conduct an analysis of estimated expenses and revenues associated with your product or service idea by completing the following:

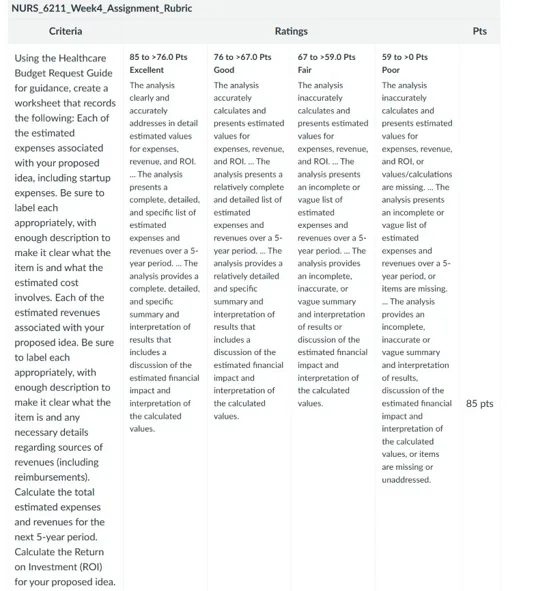

Part 1: Expense/Revenue/ROI Analysis:

Open your Excel Assignment Workbook and navigate to the “W4A3 Estimated Expenses” worksheet. Using the Healthcare Budget Request Guide for guidance, create a worksheet that records the following:

Each of the estimated expenses associated with your proposed idea, including startup expenses. Be sure to label each appropriately, with enough description to make it clear what the item is and what the estimated cost involves.

Each of the estimated revenues associated with your proposed idea. Be sure to label each appropriately, with enough description to make it clear what the item is and any necessary details regarding sources of revenues (including reimbursements).

Calculate the total estimated expenses and revenues for the next 5-year period.

Calculate the Return on Investment (ROI) for your proposed idea.

NOTE: You will copy your worksheet and analysis onto the Healthcare Budget Request Template (Word document) for submission. You must submit both the Healthcare Budget Request (a Word Document) and an Excel Spreadsheet for your Assignment submission. Please only submit your Assignment once you have uploaded these two components of your W4A3 Assignment.

Part 2: W4A3 Projected Expenses and Revenues (Five Year) Summary of Analysis and Interpretation of Results:

Create a brief (1- to 2-page) description of your analysis that clearly describes the estimated financial impact of your proposed idea. Interpret the results by explaining what your ROI calculation means to the organization. Place your analysis on the Healthcare Budget Request Template under the section titled W4A3 Projected Expenses and Revenues (Five Year).

BY DAY 7 OF WEEK 4

Submit your Assignment.

SUBMISSION INFORMATION

Before submitting your final assignment, you can check your draft for authenticity. To check your draft, access

the Turnitin Drafts from the Start Here area.

To submit your completed assignment, save your Assignment as WK4Assign_LastName_Firstinitial

Then, click on Start Assignment near the top of the page.

Next, click on Upload File and select Submit Assignment for review.

DNUR 6211 Week 4 Assignment 3 Rubrics

References For DNUR 6211 Week 4 Assignment 3

Thomas, E. E., Taylor, M. L., Banbury, A., Snoswell, C. L., Haydon, H. M., Rejas, V. M. G., Smith, A. C., & Caffery, L. J. (2021). Factors influencing the effectiveness of remote patient monitoring interventions: A realist review. British Medical Journal (BMJ) Open, 11(8). https://doi.org/10.1136/bmjopen-2021-051844

Best Professors To Choose From For DNUR 6211 Class

- Dr. Paula Stechschulte

- Dr. Christine Frazer

- Dr. Judi Kuric

- Dr. Diane Whitehead

- Dr. Linda Johanson

(FAQs) related to DNUR 6211 Week 4 Assignment 3

Question 1: Where can I download a free sample for DNUR 6211 Week 4 Assignment 3?

Answer 1: Get a free DNUR 6211 Week 4 Assignment 3 sample from Tutors Academy.

Question 2: Where can I find the rubrics and instruction file for DNUR 6211 Week 4 Assignment 3?

Answer 2: Find the rubrics and instructions for DNUR 6211 Week 4 Assignment 3 on Tutors Academy.

Question 3: What is DNUR 6211 Week 4 Assignment 3 about?

Answer 3: It involves analyzing healthcare financial data and developing strategic budget plans.

Do you need a tutor to help with this paper for you with in 24 hours.

- 0% Plagiarised

- 0% AI

- Distinguish grades guarantee

- 24 hour delivery