DNUR 6211 Week 10/11 Assignment 6 FREE DOWNLOAD

DNUR 6211 Week 10/11 Assignment 6

Final Healthcare Budget Request

W10/11A6: Summary of Analyses and Interpretation of Results

Student Name

Walden University

DNUR 6211: Finance and Economics in Healthcare Delivery

Professor Name

Date

Part 2: Summary of Analyses and Interpretation of Results

Financial statement analysis of Healthways Clinic for FY 2017 and FY 2018 indicates a positive trend in revenue and profitability growth as well as growing financial stability, though there are liquidity concerns. Income Statement analysis shows an increase of 12.33% ($61,299) in Gross Revenue and 12.31% ($48,377) in Net Patient Revenue. This growth indicates that the clinic experienced higher patient volumes and better operations (Giese et al., 2024). Operating Expenses grew only by 3% ($18,031), while Total Operating Revenue increased by 4% ($23,095) contributing to improved profitability. In the past, notably, Net Income went from a loss of $1,307 in the FY 2017 to a profit of $3,758 in the FY 2018, highlighting a strong effort at cost control and revenue enhancement.

In the Balance Sheet analysis, the clinic’s Total Assets increased by 3.95%, from $173,258 to $180,088, indicating growth in financial resources. Financial obligations seem to have fallen as Total Liabilities decreased slightly. Net Assets grew by 30.76%, from $23,674 to $30,959, showing a stronger financial position and better financial stability. Furthermore, the operational efficiency was improved and cost control was demonstrated by the decreasing Expense per Encounter (from $180.22 to $175.91), by 2.4%. The Total Operating Revenue per Encounter however decreased by 1.62%, from $179.85 to $176.93, presumably because of an increase in patient volume that led to more encounters with a marginal drop in revenue per visit. In other words, while patient volume improved, revenue per encounter remained stable but slightly lower.

The Operating Margin demonstrated substantial growth during FY 2017-2018 because it transformed from -0.21% to 0.58% which indicates the clinic turned from an unprofitable condition into a generating surplus state. The Days Cash on Hand indicator showed a dramatic downward trend from its FY 2017 value of 7.0 days to 3.2 days during FY 2018. This drop reflects reduced liquidity, which could challenge meeting short-term financial obligations without additional funding or credit lines. Overall, the clinic’s financial standing performed better during FY 2018 than in FY 2017. The clinic demonstrates successful operation management through its increased revenue and improved profitability along with enhanced financial stability. However, the decrease in Days Cash on Hand creates uncertainties regarding the clinic’s ability to meet instant cash requirements during potential large-scale service investments or unanticipated expenses.

Several assumptions were made in this analysis. It is assumed that revenue recognition is accurate and that revenues reported are collected with minimal adjustments. Expense allocation is assumed to be correct, reflecting the true costs of operations. Consistency in reporting between FY 2017 and FY 2018 is assumed, with the same accounting principles applied for comparability. Finally, the analysis assumes that the increase in patient encounters reflects sustainable growth rather than a temporary anomaly.

The results of this analysis have important implications for the proposed Remote Patient Monitoring (RPM) service. The growth in revenue and the decline in expenses per encounter suggest that RPM could generate additional income without significant increases in costs. The improvement in operating margins further indicates that RPM could strengthen the organization’s financial sustainability (Makutonin et al., 2023). However, the liquidity concern highlighted by the decrease in cash on hand calls for external funding or careful financial planning to ensure the smooth implementation of RPM. The organization’s financial position supports the introduction of RPM, but addressing cash flow challenges will be critical to its success.

Struggling with DNUR 6211 Week 6 Assignment 4? Access expert healthcare budget guides now and finish your work effortlessly!

Part 3

Healthcare Budget Request

Remote Patient Monitoring (RPM)

Student Name

Professor Name

Date

W2A2 Executive Summary

HealthWays Clinic has identified an essential gap in the management of chronic disease, especially for patients dealing with long-term conditions such as diabetes, hypertension, and heart disease. Currently, patients require frequent doctor visits and hospitalizations, which not only disrupt their lives but also contribute to escalating healthcare costs. For the most part, the lack of a system to monitor their conditions continuously — other than from usual doctor’s appointments — has resulted in unnecessary readmissions and inadequate monitoring. It would be an ideal opportunity to bridge these gaps with the use of a technological solution.

The integration of a Remote Patient Monitoring (RPM) system is proposed, which enables real-time, continuous tracking of a patient’s vital signs including blood pressure, blood glucose, weight, and pulse rate. The data will be transmitted directly to healthcare providers who will be able to observe this and intervene where needed, leading to a reduction in hospital readmissions, complications avoided, and improved patient outcomes. An increasing body of literature shows that RPM systems can be effective for the management of chronic conditions, particularly in rural areas where access to in-person healthcare may be challenging (Acharya et al., 2023). Generally, adopting RPM will decrease the load on hospitals, decrease the costs of emergency care, and ultimately improve care for both patients and the operations of facilities. This initiative is consistent with HealthWays’ broader goals to enhance patient-centered care, improve service quality, and contain costs. By adopting RPM technology, the clinic will position itself as a leader in the growing trend of digital health and telemedicine, reinforcing its reputation as a forward-thinking institution in healthcare innovation.

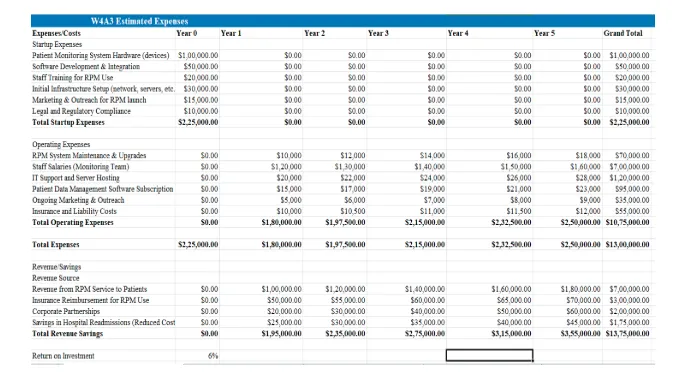

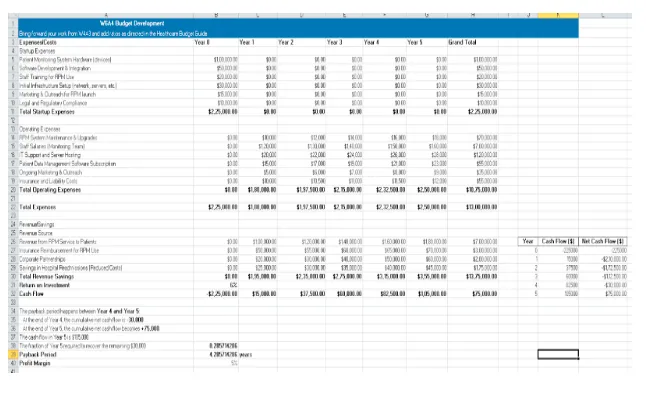

W4A3 Projected Expenses and Revenues (Five Year)

The financial analysis for HealthWays Clinic’s RPM system over the next five years indicates that the clinic will experience substantial initial and operational expenses, but these will be outweighed by projected revenues and savings over time. The total projected expenses over five years are estimated at $1.3 million. This includes a significant upfront investment of $225,000 to cover the setup costs. The five-year total annual operational costs will be about $1.075 million which includes system maintenance, IT support, staffing, and marketing expenditures.

From a revenue side, the clinic estimates by having patient service fees, insurance reimbursements, and savings from fewer hospital admissions, it should generate $1.375 million. The projected revenue breakdown is $1.2 million from patient services and partnerships and an extra $175,000 saved through reduced hospital readmission, a key objective of implementing the RPM system. This generates a modest but positive Return on Investment (ROI) of 6%. While the ROI is relatively low in financial terms, it reflects the strategic value of improving patient care and reducing long-term healthcare costs.

The ROI calculation is as follows:

- Net Profit: $1,375,000 (Total Revenue and Savings) – $1,300,000 (Total Expenses) = $75,000

- ROI = ($75,000 / $1,300,000) * 100 = 6%

The ROI demonstrates the financial viability of the RPM system, indicating its potential to enhance patient outcomes while ensuring operational sustainability. Additionally, the system offers transformative benefits, such as reducing emergency room visits and hospital admissions. This aligns with HealthWays’ mission to improve patient care while managing costs (Thomas et al., 2021).

W6A4 Projected Budget (Five Year)

The initial costs associated with launching the RPM system are considerable, leading to a projected deficit of $225,000 in Year 0. However, that deficit is projected to shrink in the future as the system generates revenue and realizes cost savings. The initial phase of implementation is forecasted to end up with a net cash flow of -$30,000 by the end of Year 4. However, by Year 5, when RPM will produce a $75,000 surplus, that will mean that the investment will be generating a positive monetary return.

Budget Breakdown

- Year 0 (Startup Costs): Total startup costs will amount to $225,000, with the largest expenditure being the purchase of hardware for the RPM system ($100,000). Additional costs include $50,000 for software development and integration, $20,000 for staff training, $15,000 for marketing and outreach, and $10,000 for legal and regulatory compliance.

- Year 1-5 (Operational Costs): Ongoing operational expenses will be approximately $1.075 million over the five years. These expenses will primarily be focused on staff salaries ($700,000), technology maintenance and upgrades ($70,000), IT support ($120,000), patient data management software subscriptions ($95,000), and marketing ($35,000). An additional $55,000 will be allocated to insurance and liability costs.

The system’s financial sustainability will be supported by gradual revenue generation from patient services and insurance reimbursements, while also saving costs related to hospital readmissions. These factors will ensure that the RPM system contributes to the clinic’s long-term success.

W10/11A6 Organizational Statement Analyses

An analysis of HealthWays Clinic’s financial statements from FY 2017 and FY 2018 reveals a positive trend in revenue growth, profitability, and financial stability. Gross Revenue increased by 12.33%, with a rise in Net Patient Revenue of 12.31%. Operating Expenses grew more slowly at 3%, contributing to improved profitability. Net Income shifted from a loss of $1,307 in FY 2017 to a profit of $3,758 in FY 2018, reflecting better cost control and enhanced operations. In the Balance Sheet analysis, Total Assets increased by 3.95%, signaling growth in financial resources. Net Assets grew by 30.76%, indicating improved financial stability. However, the reduction in “Days Cash on Hand” from 7.0 days in FY 2017 to 3.2 days in FY 2018 is a concern, as it suggests the clinic may face challenges covering immediate financial obligations.

The clinic’s improvement in profitability and revenue, coupled with a reduction in costs per patient encounter, indicates that the RPM system could generate additional income without significant increases in operational expenses (Makutonin et al., 2023). The improved operating margin further suggests that RPM could enhance the clinic’s financial health. However, the liquidity issue, as indicated by the decrease in cash reserves, must be addressed to ensure the smooth implementation of the RPM system. This may involve securing additional funding or credit lines to manage cash flow during the system’s initial phases.

W10/11A6 Summary/Elevator Speech (PPT slides)

Slide 01:

Good day, everyone. I am Evanne, Today; I am presenting the proposal for implementing a Remote Patient Monitoring (RPM) system at HealthWays Clinic. This system aims to enhance chronic disease management and reduce hospital readmissions, aligning with our clinic’s mission to improve patient care while optimizing operational efficiency. I will walk you through the benefits of this proposal, its expected financial impact, and how it fits within our long-term goals for healthcare innovation.

The Problem & Opportunity

Slide 02:

HealthWays Clinic is facing a significant challenge with chronic disease management. Typically, patients suffering from diabetes, hypertension, or heart disease need frequent medical attention, but the current system just allows them to be monitored during in-person visits with doctors. That leaves gaps in care that mean patients are readmitted to hospitals and have to go back to the emergency room, which is costly and disruptive to patients (Acharya et al., 2023). However, our opportunity lies in the implementation of a Remote Patient Monitoring system which would allow continuous monitoring of these patients’ vital signs from home. This technology, when integrated, enables us to intervene earlier and more effectively, reducing the number of hospital visits, and improving patient outcomes.

Value Proposition & Benefits

Slide 03:

The RPM system has substantial value both to patients and to the clinic. It ensures patients’ continuous monitoring of critical health metrics, such as blood pressure, glucose levels, and heart rate. It allows healthcare providers to respond quickly were a patient’s condition to deteriorate, reducing the risk of hospitalization or complications. The financial benefit is equally compelling. We expect to generate roughly $1.375 million in inpatient service fees, insurance reimbursements, and readmission savings over five years. This leads to a projected 6% return on investment (ROI), with an incremental $75,000 in profit by year five. In addition, this system goes hand in hand with HealthWays’ mission to offer high-quality, cost-effective care and is in line with our clinic as a digital health leader.

Financial Analysis & ROI

Slide 04:

The initial investment required for the RPM system is $225,000, covering hardware, software development, infrastructure setup, and staff training. We expect to achieve $1.375 million in revenue combined with savings through reduced readmissions alongside ongoing patient services over five years. This translates into a modest yet impactful 6% ROI or $75,000 in net profit. The financial projection indicates that startup expenses will produce a temporary deficit during the first few years yet the RPM system will achieve financial stability through positive cash flow by year five. The system can become profitable in less than four years based on its calculated payback period.

Call to Action & Leadership Commitment

Slide 05:

As nurse entrepreneurs and leaders, your role is crucial in driving the future of healthcare at HealthWays Clinic. The RPM system not only enhances patient care but also represents an important step toward reducing costs and improving operational efficiency. By adopting this technology, we position HealthWays as an innovator in chronic disease management and digital health. I urge leadership to support this initiative and commit to its implementation. With your backing, we can lead the way in healthcare innovation while securing long-term sustainability for our clinic. Together, we can make this vision a reality, improving patient outcomes and setting a new standard of care.

Instructions To Write DNUR 6211 Week 10/11 Assignment 6

Need instructions for this assessment? Contact us now and get expert guidance right away!

Instructions File For 6211 Week 10/11 Assignment 6

W10/11A6 FINAL HEALTHCARE BUDGET REQUEST

Once an idea has matured to the point that there is a clear understanding about the organizational and financial impact, there is typically a need to request resources to bring the idea to reality. This is typically done by submitting a budget request in the hopes of getting the idea on the budget, meaning there is organizational commitment to move forward with the idea by planning to allocate necessary resources. This commitment implies that the expenditure aligns with organizational objectives and the financial position of the organization.

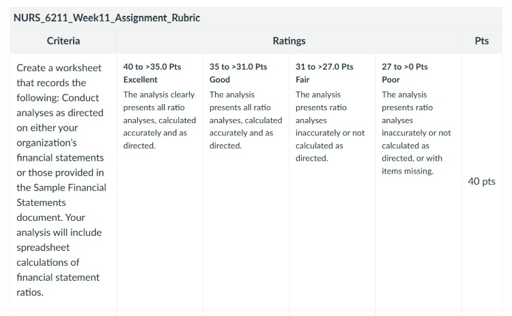

In this Assignment, you will analyze financial statements to determine the financial health of an organization.

sament as part of a final healthcare budget request

Be sure to review the Learning Resources before completing this activity. Click the weekly resources link to access the resources.

WEEKLY RESOURCES

Course, Calendar, all groups, an icon

/ous Healthcare Budget Request assignment submissions, including your executive summary, your Expense/Revenue/ROI Analysis, your estimated budget, and your ratio analysis.

Review the Excel Assignment Workbook, W10/11A6 HealthWays Financials tab. These are sample financial statements.

Reflect on the information conveyed by these statements.

If possible, secure copies of your healthcare organization’s income statement, balance sheet, and statement of cash flows. Consult with your internal financial counselor on this, as needed.

THE ASSIGNMENT

Finalize your Healthcare Budget Request by completing the following:

Part 1: Financial Statement Calculations and Analysis:

Open your Excel Assignment Workbook and navigate to the “W10/11A6 Financials” worksheet.

You have 2 Options for completing this Assignment as noted in the Excel Assignment Workbook.

Using the Healthcare Budget Request Guide for guidance, conduct analyses as directed on either your

organization’s financial statements or those provided in the HealthWays Financial Statements worksheet.

Your analysis will include spreadsheet calculation of financial statement ratios.

Part 2: Summary of Analyses and Interpretation of Results:

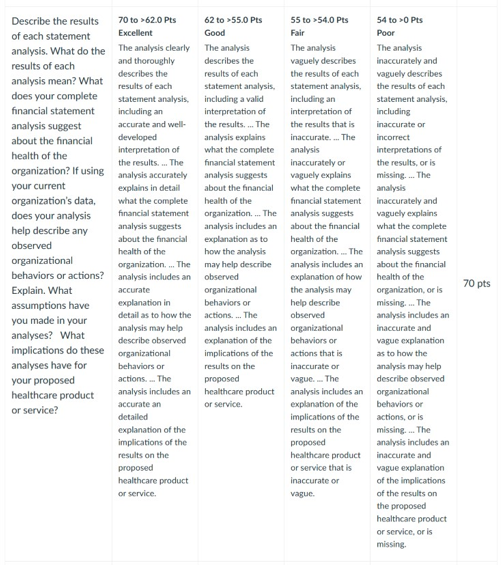

Create a brief (1- to 2-page) description of your analyses. Be sure to address the following in your summary:

Describe the results of each statement analysis. What do the results of each analysis mean?

What does your complete financial statement analysis suggest about the financial health of the organization?

If using your current organization’s data, does your analysis help describe any observed organizational

behaviors or actions? Explain.

What assumptions have you made in your analyses?

What implications do these analyses have for your proposed healthcare product or service?

Part 3: Summary of Work and Final Healthcare Budget Request

Compile and summarize your work in previous assignments. Place your final work on the Healthcare Budget

Request template. Your final Healthcare Budget Request should include:

A final version of your Executive Summary

A final version of your projected expenses and revenues

A product/service budget for the launch and the first 5 years

A summary of financial and SWOT analyses that you conducted, including your interpretation of the results

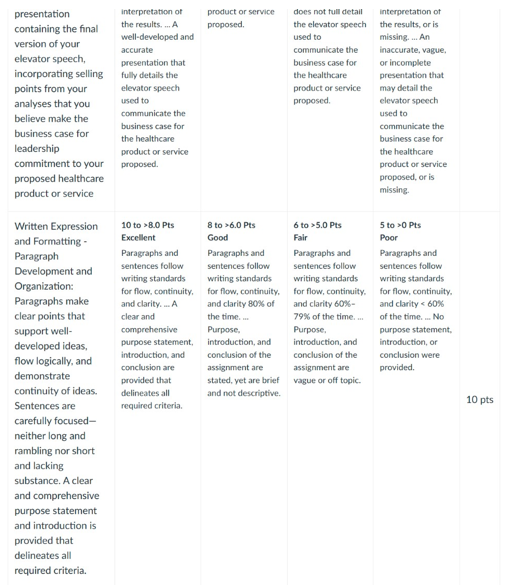

A 3- to 5-side PowerPoint presentation containing the final version of your elevator speech, incorporating

selling points from your analyses that you believe make the business case for nurse entrepreneurship and

leadership’s commitment to your proposed healthcare product or service.

BY DAY 2 OF WEEK 11

Submit your Assignment.

NOTE: You will need to submit three documents: a Word Document,an Excel Spreadsheet, and

your PowerPoint for your Assignment submission. Please be sure to only submit your Assignment

once you have uploaded these three components of your W1146 Assignment.

SUBMISSION INFORMATION

Before submitting your final assignment, you can check your draft for authenticity. To check your draft, access

the Turnitin Drafts from the Start Here area.

To submit your completed assignment, save your Assignment as WK10-11Assign_LastName_Firstinitial

Then, click on start Assignment near the top of the page.

Next, click on Upload File and select Submit Assignment for review.

DNUR 6211 Week 10/11 Assignment 6 Rubrics

References For DNUR 6211 Week 10/11 Assignment 6

Part 2:

Giese, A., Khanam, R., Nghiem, S., Rosemann, T., & Havranek, M. M. (2024). Patient-reported experience is associated with higher future revenue and lower costs of hospitals. The European Journal of Health Economics, 25(6), 1031–1039. https://doi.org/10.1007/s10198-023-01646-y

Makutonin, M., Dare, J., Heekin, M., Salancy, A., Hood, C., & Dominguez, L. W. (2023). Remote patient monitoring for hypertension: Feasibility and outcomes of a clinic-based pilot in a minority population. Journal of Primary Care & Community Health, 14. https://doi.org/10.1177/21501319231204586

Part 3:

Acharya, M., Ali, M. M., Bogulski, C. A., Pandit, A. A., Mahashabde, R. V., Hari Eswaran, & Hayes, C. J. (2023). Association of remote patient monitoring with mortality and healthcare utilization in hypertensive patients: A medicare claims–based study. Journal of General Internal Medicine. https://doi.org/10.1007/s11606-023-08511-x

Thomas, E. E., Taylor, M. L., Banbury, A., Snoswell, C. L., Haydon, H. M., Rejas, V. M. G., Smith, A. C., & Caffery, L. J. (2021). Factors influencing the effectiveness of remote patient monitoring interventions: A realist review. British Medical Journal (BMJ) Open, 11(8). https://doi.org/10.1136/bmjopen-2021-051844

Makutonin, M., Dare, J., Heekin, M., Salancy, A., Hood, C., & Dominguez, L. W. (2023). Remote patient monitoring for hypertension: Feasibility and outcomes of a clinic-based pilot in a minority population. Journal of Primary Care & Community Health, 14. https://doi.org/10.1177/21501319231204586

Best Professors To Choose From For DNUR 6211 Class

- Dr. Mary Bemker Houghtaling

- Dr. Christine Frazer

- Dr. Deanna Johnson

- Dr. Judi Kuric

- Dr. Diane Whitehead

(FAQs) related to DNUR 6211 Week 10/11 Assignment 6

Question 1: Where can I download a free sample for DNUR 6211 Week 10/11 Assignment 6?

Answer 1: Download it for free at Tutors Academy.

Question 2: Where can I find the rubrics and instruction file for DNUR 6211 Week 10/11 Assignment 6?

Answer 2: Get the rubrics and instructions at Tutors Academy.

Question 3: What is DNUR 6211 Week 10/11 Assignment 6 about?

Answer 3: It covers healthcare budgeting; details are at Tutors Academy.

Do you need a tutor to help with this paper for you with in 24 hours.

- 0% Plagiarised

- 0% AI

- Distinguish grades guarantee

- 24 hour delivery